by Author: Drew Brigham, Retail and CPG Industry Lead, Kipi.ai

The New Reality: Tariffs Reshape Retail Overnight

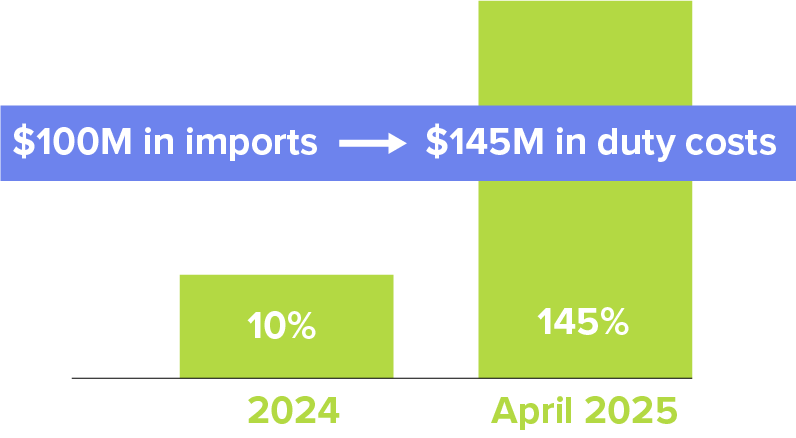

In early 2025, U.S. tariffs on Chinese imports surged from 10% to an eye-popping 145%. For many retailers, this isn’t just a line item adjustment—it is an existential financial jolt. Imagine placing a $100 million purchase order late last year under a reasonable 10% or 20% duty assumption, only to find yourself facing $145 million in duty charges as those goods arrive in port today.

This is more than policy—it’s a direct hit to cash flow, planning cycles, and profitability.

The U.S. imported more than $4 trillion in goods last year, with China remaining one of the top source markets. With this sudden shift in trade strategy, countless retailers are now scrambling to realign their pricing, supply chain decisions, and consumer engagement plans.

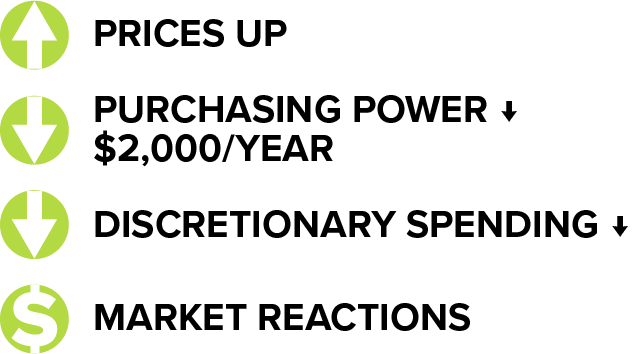

Consumer wallets are strained as well. The Yale Budget Lab estimates that household purchasing power will drop by over $2,000 annually under the current tariff structure. After years of inflation, this new pressure point threatens to suppress demand for discretionary categories just as many brands were beginning to regain momentum.

Strategic Implications for Retail Executives

This isn’t a temporary pricing challenge—it’s a cascading threat to revenue, margin, and operational agility. For senior retail leaders, particularly in merchandising, supply chain, finance, and pricing roles, the current environment demands more than tactical firefighting. It calls for immediate action paired with structural resilience.

On the demand side, shoppers are already showing signs of hesitation, especially in non-essential categories. Discretionary goods, from home decor to consumer electronics, are likely to take the brunt of slowed spending. Retailers caught with inflated inventories or poor demand forecasting will face costly markdowns or liquidations in the quarters ahead.

Meanwhile, on the operational side, businesses are incurring significantly higher costs to move goods across borders. Many are attempting to pass those costs to customers, but doing so without a precise understanding of price elasticity is risky. Too aggressive, and demand drops. Too conservative, and profit disappears.

Even more concerning is the strategic fog that surrounds the future. Policy signaling suggests that tariffs may fluctuate again before year-end. With such uncertainty, planning and scenario modeling have become critical boardroom conversations.

How Leading Retailers Are Responding

Retailers with advanced data maturity have begun navigating this environment through a three-phase approach: understanding impact, mitigating short-term exposure, and preparing for long-term adaptability.

The first step is clarity. Retailers need to quantify exactly how tariffs affect their supply chains, categories, and regional strategies. This means modeling the full financial impact of different tariff scenarios, including best- and worst-case outcomes. The speed at which a company can produce these models is often the difference between seizing opportunity and sustaining loss. Retailers operating on legacy systems, where analysts still pull from ten or more disparate sources, are at a distinct disadvantage. Those leveraging modern platforms like Snowflake can centralize cost, pricing, supplier, and demand data, enabling high-confidence decisions in real time.

Once the impact is clear, mitigation becomes the focus. Procurement teams are re-engaging supplier networks, seeking concessions, volume discounts, or changes to material composition that reduce tariff exposure. Merchants are pausing or restructuring replenishment schedules—opting to delay orders until pricing stabilizes or shifting open-to-buy budgets toward domestic or low-risk vendors.

Some retailers are already lifting prices in key categories to offset duty-driven cost increases. Yet this approach carries obvious limitations. Savvy brands are instead deploying price and promotion optimization models to strike a better balance between demand retention and margin preservation. Without machine learning-based modeling, it’s nearly impossible to optimize prices across thousands of SKUs and store locations.

Elsewhere, leaders are turning to cost discipline. Marketing spend is being reallocated toward short-term ROI-generating channels, while demand forecasting improvements are helping reduce the risk of overbuying inventory that will later need to be marked down or liquidated. Some CPG and retail brands are revisiting their demand planning and purchasing processes entirely, ensuring accuracy in models, minimal buffer, and a lower risk of overpurchasing.

Building Long-Term Resilience

For the most forward-thinking retail executives, short-term mitigation is only half the battle. The real differentiator is how companies prepare structurally for continued volatility.

Pricing and promotional models are being recalibrated to leverage machine learning models that integrate a variety of factors on top of just cost, inventory, and demand data. Retailers are also integrating market trends, inflation indices, customer responses, competitive prices, and even real-time tariff rates into their models. Forecasting capabilities are being enhanced with probabilistic modeling to account for a wider range of macroeconomic variables.

One of the most strategic long-term moves we’re seeing is supply chain diversification. While it’s tempting to think of this as a switch to flip, the reality is more complex. Building new supplier relationships requires significant legal, financial, and operational coordination. Yet this investment in optionality is becoming non-negotiable. A single-region sourcing strategy is now viewed as a margin liability.

Companies are also scenario-planning more aggressively than ever. The current tariff surge may ease next quarter—or it may intensify. But next time, it could be another factor entirely: a regulatory change, a climate disruption, or a labor strike. Smart leaders are embedding policy contingency into their strategic plans and using scenario models not just as tools for finance but as instruments of enterprise agility.

How Snowflake and Kipi.ai Empower Retailers to Move Faster

None of this is achievable without the right data foundation.

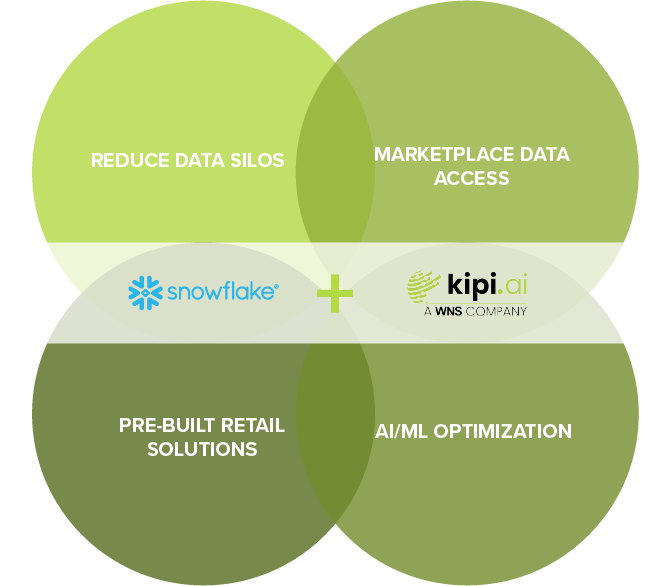

At Kipi.ai, we’ve seen firsthand how the combination of Snowflake’s data platform and our retail frameworks can accelerate a brand’s ability to understand and respond to market volatility. Where disjointed legacy systems and processes may require days or even weeks for teams to generate insights in a rapidly changing environment, Snowflake allows for instant access, collaboration, and consolidated modeling—all in a secure and scalable cloud environment.

Retailers using Snowflake can integrate pricing, supplier, merchandising, cost, and customer data into a single source of truth. They can enrich these models with data from the Snowflake Marketplace, tapping into insights like current tariff levels, shipping route disruptions, or competitive pricing. These external data layers dramatically enhance the quality of modeling and executive decision-making.

Beyond foundational data, Snowflake’s native AI and ML capabilities, when paired with Kipi.ai solutions, enable precise execution. We’re helping brands automate demand forecasting at the SKU level and run advanced marketing mix models (MMM) that ensure media spend is generating maximum return even in a profit-constrained environment.

The Strategic Mandate: Lead with Data, Not Fear

Tariffs may fluctuate in the months ahead. Change is the only constant in retail.

The question isn’t whether policy will impact your P&L—it’s whether your team can model it quickly, and act confidently in response.

For retail executives, the mandate is clear. Protect your margins. Future-proof your sourcing. Build organizational muscle to act at the speed of disruption. And above all, turn your data into a strategic asset—not just a reporting tool.

Kipi.ai and Snowflake are helping some of the world’s top retail and CPG brands do exactly that. If you’d like to see how your organization can model tariff exposure, optimize pricing, or gain forecasting precision, we’re ready to help.

Let’s Get to Work

We’re already working with retailers to improve forecast accuracy within 30 days using machine learning. If you want a preview of what this could look like for your business, get in touch. We’ll walk you through real-world examples, share dashboards, and co-build your response playbook—before the next wave hits.

About kipi.ai

Kipi.ai, a WNS company, is a leading analytics and AI services provider, specializing in transforming data into actionable insights through advanced analytics, AI, and machine learning. As an Elite Snowflake Partner, we are committed to helping organizations optimize their data strategies, migrate to the cloud, and unlock the full potential of their data. Our deep expertise in the Snowflake AI Data Cloud enables us to drive seamless data migration, enhanced data governance, and scalable analytics solutions tailored to your business needs. At kipi.ai, we empower clients across industries to accelerate their data-driven transformation and achieve unprecedented business outcomes.

For more information, visit www.kipi.ai and www.wns.com.