By Jason Ling

Executive Summary

As a property insurance provider, you’re always looking for smarter ways to grow your book of business—whether that means expanding your reach into promising new geographies, identifying ideal building characteristics for risk profiling, or tailoring your marketing efforts to the right consumer demographics. What if there were a data-driven way to do all three, in one integrated solution?

With Snowflake and its Marketplace, you now have the tools to make this possible—at scale and with precision.

We’ll show you how to build a targeted, high-impact growth strategy for both homeowners and businessowners insurance lines using the following three datasets—all easily accessible via the Snowflake Marketplace:

- Snowflake Public Data Products – US Addresses & POI (Link)

A foundational dataset that includes millions of geocoded U.S. addresses and points of interest (POIs). - Verisk Marketing Solutions – Total Property Profiles (Placekeys) (Link)

A detailed dataset containing property attributes (year built, structure type, roof material, construction type, etc.). - Verisk Marketing Solutions – Total Consumer Insights for Lifestyle (Link)

Enriched demographic and lifestyle data, including income, marital status, household composition, and purchase behavior.

Let’s walk through how to combine these datasets and use Snowflake to build a high-performance, data-first insurance growth strategy.

The Challenge – Targeted Growth in a Complex Landscape

For both homeowners’ and businessowners’ insurance, the barriers to growth are rising:

- Consumers are saturated with offers, so personalization is key.

- Property characteristics vary widely by region, creating pricing and underwriting challenges.

- Legacy data systems often only contain information about customers you have seen —preventing a view of opportunity.

You may already have an internal CRM or policy management system filled with existing customer data. But how do you scale beyond that—into new ZIP codes, customer profiles, and building types—without blindly overextending your resources?

The answer lies in data enrichment and geospatial intelligence, delivered through Snowflake’s high-performance data cloud and powered by third-party datasets.

The Solution – Unified Targeting with Snowflake and Marketplace Datasets

Step 1: Ingest & Join Key Datasets via Snowflake Marketplace

Start by subscribing to the three datasets in Snowflake Marketplace and loading them directly into your Snowflake account. No ETL pipelines needed—everything is ready for immediate SQL-based analysis. You can access 100k records from each of Verisk’s datasets.

- Use the US Addresses & POI dataset to generate a universe of physical addresses across target counties or ZIP codes. These addresses will serve as the starting point for property and consumer enrichment.

- Join with the Total Property Profiles to add rich property-level attributes:

- Year built

- Construction material

- Square footage

- Roof type

- Valuation

- Number of pools

- Join again with the Total Consumer Insights dataset using available linkages to append household-level attributes such as:

- Estimated household income

- Age of head of household

- Marital status

- Presence of children

- Financial behavior indicators

By joining across these three datasets, you now have a 360-degree profile of each potential insured property, both residential and commercial.

Step 2: Define Your Ideal Targets

Using SQL or a BI tool, create views that represent your ideal customer profiles. For example:

- Homeowners:

- Property: Single-family homes, built after 1990, over 2,000 sq ft, composition roof

- Household: Age 35–55, married, household income > $100K, presence of children

- Businessowners:

- Property: Commercial properties < 20,000 sq ft, in urban/suburban corridors, sprinkler-equipped

- POI: Retail, food service, professional offices

- Owner demographics: Small business owner, household income > $80K

Remove Existing In-Force Policies

Before moving forward, it’s critical to remove addresses already insured by you from the list of potential opportunities.

- Load your in-force policy portfolio into Snowflake as a secure internal dataset.

- Match addresses using Placekey, geocode, or normalized street address fields.

This ensures your marketing and outreach budget focuses entirely on new growth, not existing policyholders.

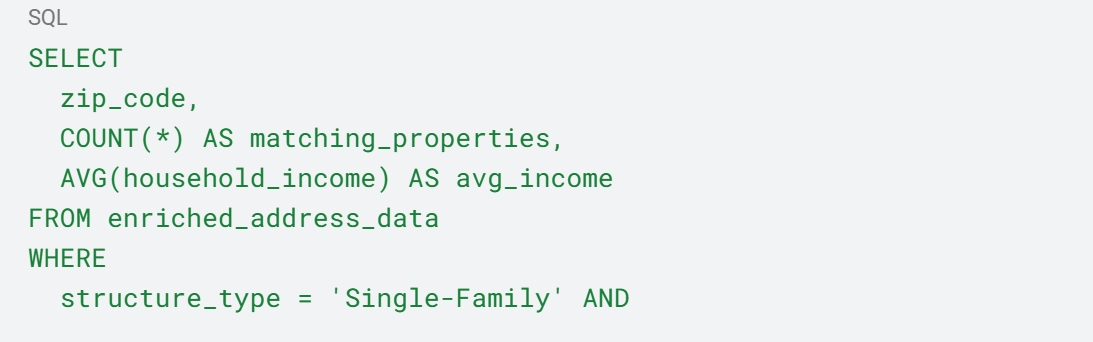

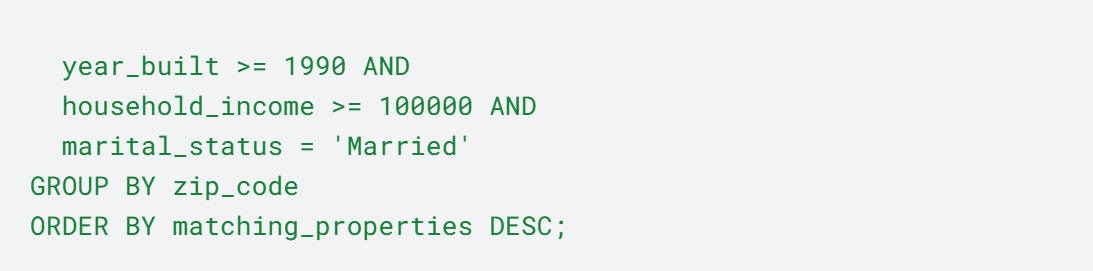

Step 3: Score & Prioritize Opportunity Regions

With the enriched dataset, you can now score each geographic region (ZIP, tract, county) based on the density of high-fit addresses, current aggregations, and exposure management guidelines. For example:

This allows you to map hotspots for direct marketing, agency deployment, or digital advertising.

Execution – Bringing It All Together with Snowflake

Use Snowflake for Marketing Activation

Once your target list is defined, use Snowflake’s data sharing and data clean room capabilities to activate campaigns in downstream platforms:

- Share high-intent address segments with digital advertising platforms via Snowflake Native Apps or clean rooms.

- Use enrichment to create custom audiences for email or direct mail campaigns.

- Deliver scored address lists to agency partners in real-time via secure data sharing.

Monitor, Optimize, Repeat

Monitor campaign performance:

- Are certain ZIP codes converting better?

- Is one demographic profile more responsive?

- How many addresses from the targeted list have actually been converted?

Loop this feedback back into your segmentation model to continually refine and optimize.

In the modern insurance landscape, data is no longer optional—it’s your competitive edge. By leveraging Snowflake Marketplace datasets and building your solution in the Snowflake Data Cloud, you can grow smarter, not just bigger.

With US Addresses & POI, Property Profiles, and Consumer Insights at your fingertips, you’re no longer flying blind. You’re strategically deploying capital and campaigns where they’ll make the biggest impact.

Ready to See It in Action?

Discover how leading insurers are using Snowflake and Marketplace datasets to target the right properties and people with precision. Contact us here.

About kipi.ai

Kipi.ai, a WNS Company, is a global leader in data modernization and democratization focused on the Snowflake platform. Headquartered in Houston, Texas, Kipi.ai enables enterprises to unlock the full value of their data through strategy, implementation and managed services across data engineering, AI-powered analytics and data science. As a Snowflake Elite Partner, Kipi.ai has one of the world’s largest pools of Snowflake-certified

talent—over 600 SnowPro certifications—and a portfolio of 250+ proprietary accelerators, applications and AI-driven solutions. These tools enable secure, scalable and actionable data insights across every level of the enterprise.Serving clients across banking and financial services, insurance, healthcare and life sciences, manufacturing, retail and CPG, and hi-tech and professional services, Kipi.ai combines deep domain excellence with AI innovation and human ingenuity to co-create smarter businesses. As a part of WNS, Kipi.ai brings global scale and execution strength to accelerate Snowflake-powered transformation world-wide.

For more information, visit www.kipi.ai